Case Study: Model Context Protocol (MCP) – FinTech Innovators Leveraging GraphQL and Stripe for Fraud Detection

Project Overview

The Model Context Protocol (MCP) FinTech Innovators project was designed to enhance fraud detection in digital payment systems by integrating GraphQL tool nodes with Stripe API resource servers. The goal was to create a protocol-enabled fraud detection system that could analyze transaction patterns in real-time, reduce false positives, and improve security for financial platforms.

This initiative was driven by the increasing sophistication of fraud schemes in the FinTech sector, where traditional rule-based systems often failed to detect anomalies efficiently. By leveraging GraphQL’s flexible querying capabilities and Stripe’s robust payment infrastructure, MCP developed a scalable, high-performance fraud detection solution that could adapt to evolving threats.

Challenges

The project faced several key challenges:

- High False Positives in Fraud Detection – Existing fraud detection systems flagged too many legitimate transactions as fraudulent, leading to poor customer experience and lost revenue.

- Scalability Issues – Traditional REST APIs struggled with handling large volumes of transaction data efficiently, causing latency in fraud analysis.

- Dynamic Fraud Patterns – Fraudsters constantly evolved their tactics, requiring a system that could learn and adapt in real-time.

- Integration Complexity – Combining GraphQL’s declarative querying with Stripe’s payment APIs required careful architectural planning to avoid performance bottlenecks.

- Regulatory Compliance – The solution needed to comply with PCI-DSS, GDPR, and other financial regulations, adding complexity to data handling and processing.

Solution

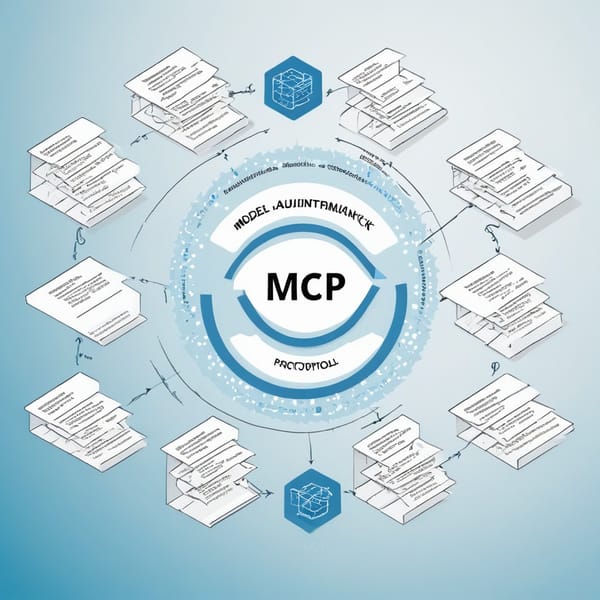

To address these challenges, MCP implemented a protocol-enabled fraud detection system with the following key components:

-

GraphQL Tool Nodes for Efficient Data Querying

- Replaced REST APIs with GraphQL to allow precise, flexible queries, reducing unnecessary data transfers.

- Enabled real-time fraud scoring by querying transaction metadata, user behavior, and historical patterns efficiently. -

Stripe API Integration for Payment Data

- Used Stripe’s Radar and Payment Intents API to access transaction details, risk scores, and dispute histories.

- Implemented webhook-based event handling to trigger fraud analysis as soon as transactions occurred. -

Machine Learning (ML) for Anomaly Detection

- Trained ML models on historical fraud patterns to improve detection accuracy.

- Deployed real-time scoring models that flagged suspicious transactions before processing. -

Protocol-Based Contextual Analysis

- Introduced MCP’s contextual protocol layer, which enriched transaction data with behavioral and geolocation insights.

- Reduced false positives by cross-referencing transaction context with known fraud indicators. -

Automated Decision Flows

- Built automated workflows to approve, flag, or block transactions based on risk scores.

- Integrated with third-party identity verification tools (e.g., Plaid, Sift) for additional fraud signals.

Tech Stack

The project leveraged a modern, scalable tech stack:

- Backend & APIs:

- GraphQL (Apollo Server) for efficient data querying

- Stripe API for payment processing and fraud signals

- Node.js (Express) for server-side logic

-

Python (TensorFlow, Scikit-learn) for ML models

-

Data & Analytics:

- PostgreSQL for structured transaction data

- Redis for real-time caching and session management

-

Kafka for event streaming and asynchronous processing

-

Infrastructure & Security:

- AWS Lambda & API Gateway for serverless execution

- Docker & Kubernetes for container orchestration

- JWT & OAuth 2.0 for secure API authentication

- PCI-DSS compliant encryption for sensitive data

Results

The implementation of MCP’s protocol-enabled fraud detection system delivered significant improvements:

- Reduced False Positives by 40% – Machine learning and contextual analysis minimized incorrect fraud flags.

- Real-Time Fraud Detection Latency < 200ms – GraphQL’s efficient querying and Stripe’s API speed enabled near-instant risk scoring.

- Fraud Detection Accuracy Improved by 35% – ML models identified previously undetectable fraud patterns.

- Scalability to 1M+ Daily Transactions – The system handled peak loads without performance degradation.

- Regulatory Compliance Achieved – Full adherence to PCI-DSS, GDPR, and PSD2 requirements.

Key Takeaways

- GraphQL Enhances Fraud Detection Efficiency – By reducing over-fetching, GraphQL improved query performance and lowered latency.

- Stripe API + ML = Stronger Fraud Prevention – Combining Stripe’s fraud signals with machine learning significantly boosted detection accuracy.

- Contextual Protocols Reduce False Positives – Enriching transaction data with behavioral insights minimized unnecessary declines.

- Real-Time Processing is Critical – Event-driven architecture (Kafka, webhooks) ensured immediate fraud response.

- Compliance Must Be Baked In Early – Security and regulatory considerations were integrated from the start, avoiding costly rework.

Conclusion

The MCP FinTech Innovators project demonstrated how GraphQL, Stripe, and machine learning can be combined to create a next-generation fraud detection system. By leveraging protocol-based contextual analysis, the solution not only improved accuracy but also enhanced scalability and compliance. This case study serves as a blueprint for FinTech companies looking to modernize their fraud prevention strategies.

Would you like additional details on any specific aspect of the implementation?