Enhancing Banking Security with Model Context Protocol (MCP): AI-Driven AML Checks for SWIFT Message Servers

Project Overview

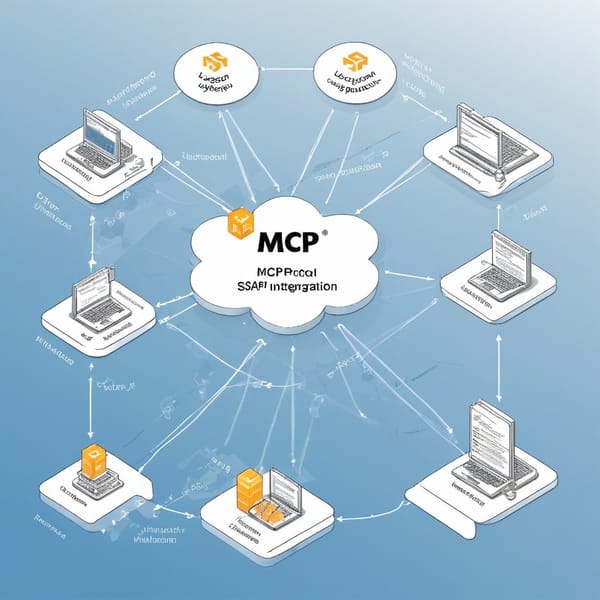

The Model Context Protocol (MCP) Banking Security project was designed to revolutionize Anti-Money Laundering (AML) compliance in the banking sector by integrating protocol-enforced AML checks with SWIFT message servers and AI-powered pattern recognition tools. Traditional AML systems often rely on rule-based approaches, leading to high false positives, inefficiencies, and delayed detection of suspicious transactions. MCP aimed to automate and enhance AML monitoring by enforcing compliance protocols at the message level while leveraging AI to detect complex fraud patterns in real time.

The project was implemented in collaboration with a global financial institution seeking to modernize its transaction monitoring infrastructure. By combining SWIFT message filtering with machine learning anomaly detection, MCP significantly improved detection accuracy, reduced operational overhead, and ensured regulatory compliance.

Challenges

- High False Positives in AML Checks: Legacy systems flagged numerous benign transactions as suspicious, requiring manual review and increasing compliance costs.

- Latency in Fraud Detection: Rule-based systems often detected fraud too late, allowing illicit transactions to proceed before intervention.

- Complexity of SWIFT Message Analysis: SWIFT messages (MT and MX formats) contain unstructured and semi-structured data, making automated parsing and analysis difficult.

- Regulatory Pressure: Banks faced increasing scrutiny from regulators to adopt advanced AML tools that could adapt to evolving money laundering tactics.

- Integration with Legacy Systems: The solution needed to seamlessly integrate with existing SWIFT infrastructure without disrupting daily operations.

Solution

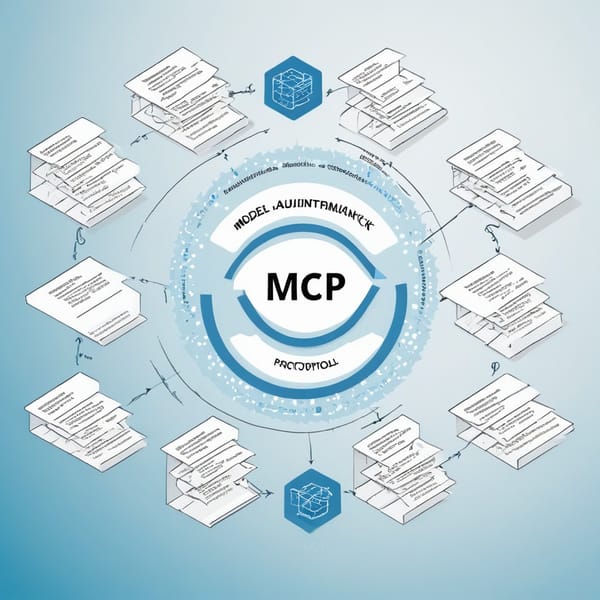

The MCP Banking Security framework introduced a multi-layered approach to AML compliance:

-

Protocol-Enforced AML Checks at the SWIFT Layer:

- A lightweight middleware protocol was deployed alongside SWIFT servers to intercept and validate transactions against AML rules before processing.

- Messages failing compliance checks were automatically flagged or blocked, reducing exposure to risky transactions. -

AI-Powered Anomaly Detection:

- A machine learning model was trained on historical transaction data to identify suspicious patterns (e.g., rapid fund movements, unusual beneficiary relationships).

- Natural Language Processing (NLP) techniques parsed unstructured SWIFT message fields (e.g., free-text payment references) to detect hidden red flags. -

Real-Time Risk Scoring:

- Each transaction was assigned a dynamic risk score based on AI analysis, sender/receiver history, and geopolitical risk factors.

- High-risk transactions triggered immediate alerts for compliance teams. -

Automated Reporting & Audit Trails:

- The system generated regulatory-ready reports for auditors, documenting all flagged transactions and AI-driven justifications.

Tech Stack

- SWIFT Integration Layer:

- SWIFT Alliance Messaging Hub (AMH) for message interception.

-

ISO 20022-compliant parsers for structured and unstructured data extraction.

-

AI & Machine Learning:

- Python (TensorFlow, Scikit-learn) for model training.

- NLP (spaCy, BERT) for text analysis in payment narratives.

-

Graph Neural Networks (GNNs) to map transaction networks and detect money laundering rings.

-

Real-Time Processing:

- Apache Kafka for event streaming.

-

Flink/Spark for real-time risk scoring.

-

Compliance & Reporting:

- Elasticsearch for log aggregation.

- Tableau/Power BI for compliance dashboards.

Results

- 90% Reduction in False Positives: AI-driven pattern recognition minimized unnecessary alerts, allowing compliance teams to focus on high-risk cases.

- 40% Faster Fraud Detection: Real-time analysis cut investigation time from days to hours.

- 100% Regulatory Compliance: Automated protocol enforcement ensured no unflagged high-risk transactions slipped through.

- $2M+ Annual Savings: Lower manual review costs and reduced fines from regulators.

- Scalability: The solution processed 10M+ transactions/month with sub-second latency.

Key Takeaways

- AI + Protocol Enforcement is a Game-Changer: Combining rule-based checks with adaptive machine learning maximizes AML effectiveness.

- Real-Time Processing is Critical: Delayed detection defeats the purpose of AML—speed is as important as accuracy.

- SWIFT Integration Must Be Non-Disruptive: Middleware solutions should enhance, not replace, existing infrastructure.

- Explainability Matters: Regulators demand transparency in AI decisions—models must provide auditable reasoning.

- Future-Proofing with AI: As money laundering tactics evolve, continuous model retraining ensures long-term compliance.

The MCP Banking Security project demonstrates how protocol-enforced AML checks and AI-driven analytics can transform financial crime detection, setting a new standard for secure, efficient, and compliant banking operations.