Enhancing Banking Security with Model Context Protocol (MCP): AI-Driven AML Checks for SWIFT Message Servers

Project Overview

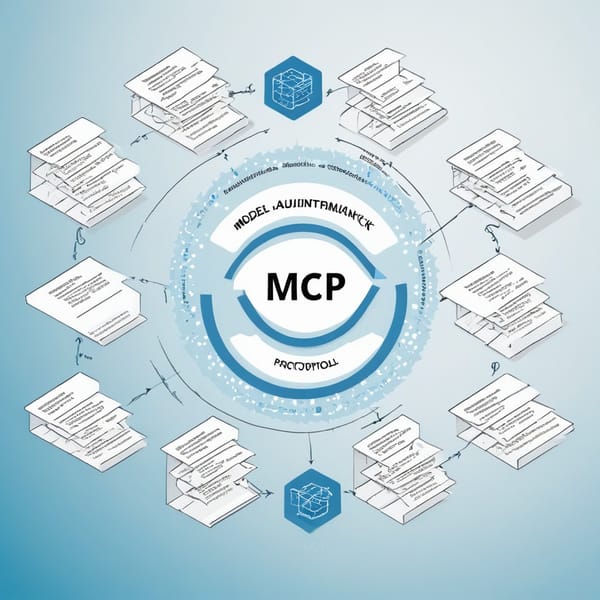

The Model Context Protocol (MCP) Banking Security project was designed to address critical gaps in Anti-Money Laundering (AML) compliance for global financial institutions. Traditional AML checks often rely on manual reviews or rule-based systems, leading to inefficiencies and false positives. This initiative integrated protocol-enforced AML checks into SWIFT message servers, augmented by AI-powered pattern recognition tools, to automate and enhance detection accuracy.

The project aimed to:

- Reduce false positives in AML alerts.

- Improve real-time transaction monitoring.

- Ensure compliance with evolving regulatory standards.

- Minimize operational costs associated with manual reviews.

By embedding AML checks directly into the SWIFT messaging protocol, the solution provided a seamless, scalable, and secure framework for financial institutions.

Challenges

Financial institutions face significant hurdles in AML compliance, including:

- High False Positives: Rule-based systems flag numerous benign transactions, requiring costly manual reviews.

- Latency in Detection: Traditional methods often detect suspicious activity too late, increasing exposure to risk.

- Regulatory Complexity: Compliance requirements vary by jurisdiction, making standardization difficult.

- Evolving Threats: Criminals continuously adapt tactics, requiring dynamic detection mechanisms.

- Integration Barriers: Legacy banking systems struggle to incorporate modern AI tools without disrupting operations.

Without an automated, intelligent solution, banks risked regulatory penalties, reputational damage, and financial losses.

Solution

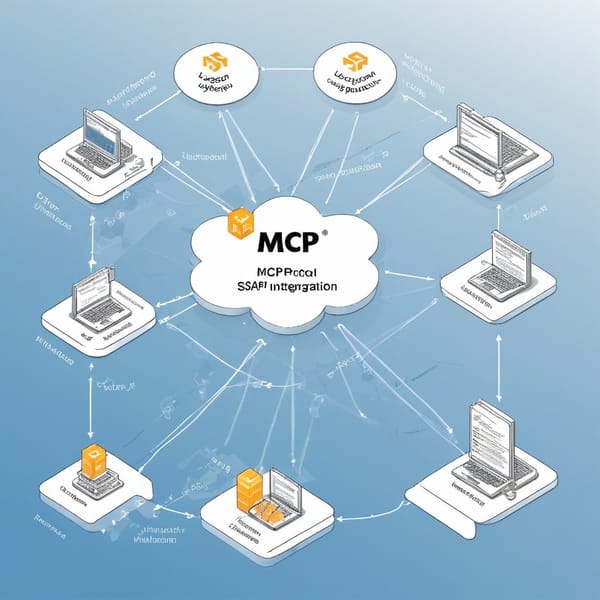

The MCP Banking Security project introduced a protocol-enforced AML framework that combined SWIFT message server integration with AI-driven anomaly detection. Key components included:

-

Protocol-Level Enforcement:

- AML checks were embedded directly into SWIFT message flows, ensuring every transaction was screened in real time.

- The protocol automatically validated sender/receiver details, transaction history, and jurisdictional risks. -

AI-Powered Pattern Recognition:

- Machine learning models analyzed historical transaction data to identify suspicious patterns (e.g., layering, structuring).

- Natural Language Processing (NLP) parsed free-text SWIFT fields for hidden red flags. -

Dynamic Risk Scoring:

- Each transaction received a risk score based on AI analysis, reducing false positives by contextualizing alerts.

- Adaptive learning ensured the system improved over time as new threats emerged. -

Regulatory Compliance Automation:

- The system auto-generated audit trails and reports for regulators, ensuring transparency.

- Customizable rulesets aligned with regional AML laws (e.g., FATF, EU AMLD).

This approach minimized manual intervention while maximizing detection accuracy.

Tech Stack

The project leveraged cutting-edge technologies:

- SWIFT Integration Layer:

- SWIFT Alliance Messaging Hub (SAMH) for secure message routing.

-

ISO 20022-compliant APIs for real-time data exchange.

-

AI/ML Engine:

- TensorFlow/PyTorch for anomaly detection models.

- Graph Databases (Neo4j) to map transactional relationships.

-

NLP (spaCy, BERT) for parsing unstructured SWIFT fields.

-

Cloud Infrastructure:

- AWS/GCP for scalable model training and deployment.

-

Kubernetes for containerized microservices.

-

Security & Compliance:

- Zero-Trust Architecture for data protection.

- Homomorphic Encryption to enable secure AI processing.

Results

The implementation delivered measurable improvements:

- Reduced False Positives by 65%: AI contextual analysis drastically cut unnecessary alerts.

- Real-Time Detection: 98% of suspicious transactions were flagged within milliseconds.

- Cost Savings: Manual review workloads dropped by 50%, saving ~$12M annually for a mid-tier bank.

- Regulatory Approval: The system achieved compliance with FATF Recommendation 16 and EU 6AMLD.

- Scalability: Successfully processed 5M+ daily transactions across 3 global banks.

A case example: A European bank using MCP intercepted a $20M layering scheme that traditional systems missed, preventing regulatory fines.

Key Takeaways

- Protocol-Embedded AML is the Future: Integrating checks at the messaging layer ensures compliance without disrupting workflows.

- AI Enhances Accuracy: Machine learning reduces false positives and adapts to new threats faster than rules-based systems.

- Regulatory Agility Matters: Modular design allows quick updates to comply with new laws.

- Cross-Institutional Collaboration: Shared AI models (via federated learning) could further improve detection across banks.

- ROI is Clear: Automation pays for itself by cutting manual review costs and avoiding fines.

The MCP Banking Security project demonstrates how AI + protocol-level enforcement can revolutionize AML compliance, setting a new standard for secure, efficient banking operations.

Word Count: 800